Advantage of Investing in Mutual Funds:

- Transparency : Daily NAV

- Safety : Regulated by SEBI

- Low Risk : Due to Diversification

- Low Cost : Due to investment in Pool

- Liquidity : Open Ended in nature

- Tax Efficient : Check Taxation details

- Better returns : Historically proven

Methods of Investing :

- Lumpsum: While investing lumpsum, you need to select funds with better tax efficiency and better growth potential

- Recurring or Systematic ( SIP): While investing through SIP, you need to select funds with high beta to take cost averaging advantage

Type of Mutual Fund Products :

Every mutual fund product is divided into one of these five Risk category , as defined and mandated by SEBI

The below table gives a snapshot of risk profiles of some mutual fund categories as promoted by us:

| Low Risk | Moderately Low Risk | Moderate Risk | Moderately High Risk |

|---|---|---|---|

| Liquid Funds | Short-duration Funds, Ultra Short-duration Funds | Fixed Maturity Plans (FMPs) | Large Cap Funds, Mid and Small Cap Funds, Balanced Funds |

RBI Bond Floating Rate Savings Bonds 2020 (Taxable)

| Item | Details | Remarks |

| 1. Eligibility for Investment | The Bonds may be held by - (i) a person resident in India, (a) in her or his individual capacity, or (b) in individual capacity on joint basis, or (c) in individual capacity on any one or survivor basis, or (d) on behalf of a minor as father/mother/legal guardian (ii) a Hindu Undivided Family |

Non-Resident Indians (NRI)s are not eligible to invest in these bonds. |

| 2. Form of the Bonds | Electronic form held in the Bond Ledger Account. | Bond Ledger Account will be opened by the Receiving Office in the name of investor/s. |

| 3. Maturity period | 7 years from the date of issuance. | --- |

| 4. Period | The Bonds shall be repayable on the expiration of 7 (Seven) years from the date of issue. Premature redemption shall be allowed for specified categories of senior citizens. | --- |

| 5. Limit of investment | Minimum ₹ 1000/- and in multiples of ₹ 1000/-. | No maximum limit. |

| 6. Interest Rate (Floating) | (i) Interest is payable semi-annually from the date of issue of bonds, up to 30th June / 31st December as the case may be, and thereafter half-yearly for period ending 30th June and 31st December on 1st July and 1st January respectively. (ii) The coupon rate payable for next half-year would be reset on 1st January 2021 and thereafter, every 1st July and 1st January. |

Half-yearly interest is payable on 1st January / 1st July. The coupon on 1st January 2021 shall be paid at 7.15%. |

| 7.Tax treatment | Income from the bonds is taxable. | Tax will be deducted at source while interest is paid. If an exemption under the relevant provisions of the Income Tax Act,1961 is obtained, it may be declared in the Application Form. |

| 8.Transferability | The bonds are not transferable. | Transferability is limited to nominee(s)/legal heir in case of death of holder. |

| 9.Tradability /Advances | The bonds are not tradable in the secondary market and also not eligible as collateral for availing loans. |

--- |

| 10. Nomination | A sole holder or a sole surviving holder of a Bond, being an individual, can make a nomination. | --- |

| 11. Date of Issue of bonds | Date of receipt of subscription in cash (up to `20,000/- only), or date of realization of cheque /draft/ funds. |

--- |

| 12. Premature redemption | Facility is available to the eligible investors after Lock in period of 4, 5, and 6 years in the age bracket of 80 years and above, between 70 to 80 years and 60 to 70 years respectively |

Penalty charges @ 50% of last coupon payment. |

| 13. Nomination Facility | The sole Holder or all the joint holders may nominate one or more persons as nominee in accordance with the provisions of the Government Securities Act, 2006 (38 of 2006) and the Government Securities Regulation, 2007, published in Part III, Section 4 of the Gazette of India dated December 1, 2007. |

--- |

| 14. Bank account | It is mandatory for the investor/s to provide bank account details to facilitate payment of interest /maturity value directly to his/her/their bank account. |

--- |

54EC Bonds

54EC bonds, or capital gains bonds, are one of the best way to save long-term capital gain tax. 54EC bonds are specifically meant for investors earning long-term capital gains and would like tax exemption on these gains. Tax deduction is available under section 54EC of the Income Tax Act. 54EC bonds do not allow any tax exemption on short-term capital gains tax. Invest in 54EC bonds to get benefits of tax deduction. The maximum limit for investing in 54EC bonds is Rs. 50,00,000. The eligible bonds under Section 54EC are REC (Rural Electrification Corporation Ltd), PFC (Power Finance Corporation Ltd) and NHAI (National Highways Authority of India) and IRFC (Indian Railways Finance Corporation Limited).

Key Features of 54EC Bonds

54EC bonds are popular investment instruments as investing in 54EC bonds allows investors to claim tax deductions on long-term capital gains. 54EC bonds also offer other features.

- Safe and Secure: 54EC bonds are AAA rated.

- Interest: Interest on 54EC bonds is taxable. No TDS is deducted on interest from 54EC bonds and wealth tax is exempted.

- Tenure: 54EC bonds come with a lock-in period of 5 years (effective from April 2018) and are non-transferable.

- Investment amount: Minimum investment in 54EC bonds is 1 bond amounting to Rs. 10,000 and the maximum investment in 54EC bonds is 500 bonds amounting to Rs 50 lakhs in a financial year.

- Interest Rate: 54EC bonds offer 5.75% rate of interest payable annually.

Key Benefits of 54EC Bonds

Individuals as well as members of HUF can make investments in 54EC bonds. You should invest in 54EC bonds within 6 months of transferring capital asset. Take a look at the benefits of investing in 54EC bonds.

Bonds offered under sec 54EC

With effect from FY 2018-19, benefit of investing in 54EC bonds would be available on sale of land or building (residential or commercial). The capital gains 54EC bonds eligible for tax deductions can be issued only by REC (Rural Electrification Corporation Ltd), PFC (Power Finance Corporation Ltd) and NHAI (National Highways Authority of India). Avail the opportunity to invest in 54EC bonds to gain tax deductions.

Send whatsapp to get Forms  +916359131666

+916359131666

Click here to Post your query

FAQs

Why to invest in 54 EC bonds?

The gains that arise on the sale of a Long Term Capital Gain Asset are known as Long Term Capital Gains and Capital Gains Tax is levied on such gains. However, such tax can be saved if this amount is invested in capital gain bonds specified under section 54 EC.

Which bonds are eligible under the Section 54 EC?

REC (Rural Electrification Corporation), NHAI (National Highways Authority of India), IRFC (Indian Railway Finance Corporation) & PFC (Power Finance Corporation Ltd) are the bonds eligible under Section 54 EC.

What is the mode of application?

You can apply for the 54 EC bonds offline with physical forms.

What are the modes of payment?

The payment can be done through cheque, DD or RTGS

Fixed Deposits

Fixed deposit is investment instruments offered by banks and non-banking financial companies, where you can deposit money for a higher rate of interest than savings accounts. You can deposit a lump sum of money in fixed deposit for a specific period, which varies for every financier.

Once the money is invested with a reliable financier, it starts earning an interest based on the duration of the deposit. Usually, the defining criteria for FD is that the money cannot be withdrawn before maturity, but you may withdraw them after paying a penalty.

Gold Sovereign Bond

SGBs are government securities denominated in grams of gold. They are substitutes for holding physical gold. Investors have to pay the issue price in cash and the bonds will be redeemed in cash on maturity. The bonds are issued by RBI on behalf of the government.

Benefits

The quantity of gold for which the investor pays is protected, since he receives the ongoing market price at the time of redemption/ premature redemption. The SGB offers a superior alternative to holding gold in physical form. The risks and costs of storage are eliminated. Investors are assured of the market value of gold at the time of maturity and periodical interest. SGB is free from issues like making charges and purity in the case of gold in jewellery form. The bonds are held in the books of the RBI or in demat form eliminating risk of loss of scrip etc.

Eligibility

Persons resident in India as defined under Foreign Exchange Management Act, 1999 are eligible to invest in SGB. Eligible investors include individuals, HUFs, trusts, universities and charitable institutions. Individual investors with subsequent change in residential status from resident to non-resident may continue to hold SGB till early redemption/maturity.

Liquidity

- Traded the Secondary Market

- Can be used as collateral for loans

Redemption

- Equal to the average of the closing price of 999 purity gold of the previous 3 business days as Published by IBJA

Tax for Individuals

- Interest is taxed at applicable slab rates

- Capital gains is exempt if held till maturity (Taxed if redeemed early)

Minimum Investment

- Equivalent 1 gram of gold

Maximum Investment

- Individuals & HUFs (up to 4kg*)

- Trusts & Other similar entities (up to 20kg*)

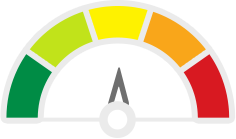

So, which risk profile is suitable for you?

You can understand which risk profile is suitable for you with the help of the below table:

| Risk Profile | Type of Investor |

|---|---|

| Low Risk | Investors willing to accept low returns for high safety of principal amount. |

| Moderately Low Risk | Investors willing to take a small amount of risk for potential returns. |

| Moderate Risk | Investors willing to accept a moderate level of risk for moderate returns. |

| Moderately High Risk | Investors willing to take relatively high risk for high returns. |

| High Risk | Investors willing to lose capital for significantly high returns. |

Aapkabanker encourages you to align your Risk profile with the product Risk profile. Remember,

everytime you make your investments, you must score your self ( under the scale of 0 to 10) in terms of : S : Safety | L : Liquidity | R : Returns

Say example, you give 8 points to Safety then you are left with 1 point each for Liquidity and returns . And if you give 8 points to Returns the you are left with 1 point each for Safety and Lqiuidity.

So it is a simple game of Risk vs Reward ! You have decide the quantum of Risk according to your desired reward.

Our commitment to our investors : We provide you the most suitable product for investments and your wealth growth. We have a special Risk Profiling process in place to do the same

-Dipak Rasadia

Aapkabanker is a banker of your dream!

We make sure that you achieve all your Financial Goals with right amount in right duration.

There can be multiple point of cash flow which needs to be arranged for, to avoid any sudden financial crisis or shortfall

Create a Goal with our Free Financial Planner Tool, and save it under your

secured login at www.aapkabanker.com